retroactive capital gains tax meaning

The book account may have been reduced by the transfers to capital or other accounts in the form of stock dividends or reserves. Capital Gains and Dividends Taxes.

Capital Gains Tax In The United States Wikipedia

But that ended as.

. If you live outside the United States you may be able to exclude part or all of your foreign earned income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. Tax-Free Savings Account - TFSA.

Form 990 is an annual information return required to be filed with the IRS by most organizations exempt from income tax under section 501a and certain political organizations and nonexempt charitable trustsParts I through XII of the form must be completed by all filing organizations and require reporting on the organizations exempt and other activities finances governance. Excise and Consumption Taxes. Tax-free savings accounts.

The text then discusses the priority disputes between the federal tax and competing liens. Forms 990-T 4720 are available for e-filing in 2022. In fiscal year 202021 CalPERS paid over 274 billion in retirement benefits and over 974 billion in health benefits.

3 state income tax. Interest dividends capital gains rental and royalty income non-qualified annuities income from businesses involved in trading of financial instruments or commodities and businesses that are passive activities to the taxpayer within the meaning of section 469. In general investment income includes but is not limited to.

Such as interest dividends capital gains pensions rents and royalties. The taxation of capital gains depends on whether such gains are long-term meaning gains or losses from investments held for more than one year ie 12 months and one day or longer or short-term meaning gains and losses from investments held for one year or less. Content Writer 247 Our private AI.

Last-in First-out LIFO and First-in First-out FIFO are two methods of inventory accounting used for both financial accounting and tax purposes. Meaning that it is given in all income wages pensions capital and business income. Engine as all of the big players - But without the insane monthly fees and word limits.

Unlike ordinary allowable capital. The Service argued that the taxpayer was. 5 expenses for the cost of health insurance dental insurance or cash medical support for the obligors child ordered by the court under Sections 154182 and 1541825.

2 federal income tax based on the tax rate for a single person claiming one personal exemption and the standard deduction. Special rules for eligible gains invested in Qualified Opportunity Funds. 9530 generally made a downward revision of tax table for married individuals filing separate returns resulting in a table under which among other changes a bottom bracket imposing no tax on taxable income of 1600 or less was substituted for a bottom bracket under which a tax of 14 had been imposed on a taxable income of 500 or less.

Tool requires no monthly subscription. Meaning if you make 11000 - after you deduct the standard 12500 - your adjudt gross income is ZERO so there is nothing to tax. B also reported to A that no income was earned in Year 1 and that for each of the Years 2 through 7 the investments earned 10 x of income interest dividends and capital gains which A.

The prohibition against retroactive laws in the Constitution 97 is an example of such a restriction. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. Explore the list and hear their stories.

This principle often comes into conflict with the economic principle of deducting costs when. Retroactive SALT Repeal Combines Weak. B also issued tax reporting statements to A and to the Internal Revenue Service that reflected purported gains and losses on A s investment account.

A taxpayers business investment loss is basically a capital loss from a disposition of shares in or a debt owing to the taxpayer by a small business corporation SBC where the disposition is. This section first explains how the federal tax lien arises its duration and the effect of filing a Notice of Federal Tax Lien NFTL. Or business as referred to in IRC 482.

3 The difference in tax treatment is significant because long-term. Over 500000 Words Free. 1202 was enacted in 1993 before the maximum capital gain rate for noncorporate taxpayers was reduced in 1997 to 20 and then in 2003 to 15 for 2013 it is back up to 20 but only for taxpayers in the 396 income tax bracket.

41013 Certain Technical Issues 410131 Section Overview 410132 Accumulated Earnings Tax IRC 53 Skip to main content. One to which subsection 501 applies. Your guide to the future of financial advice and connection.

Ordering tax forms instructions and publications. For the first several years after the health insurance marketplacesexchanges debuted for 2014 coverage the premium subsidy premium tax credit eligibility range was capped at household incomes of 400 of the federal poverty level People with incomes above 400 of FPL were on their own when it came to paying for health insurance. Company shareholders were exempt from dividend and capital gains tax.

It needs to be a capital gain over what you already paid taxes for in order to pay taxes again. This applies to earned income such as wages and tips as well as unearned income such as interest dividends capital gains pensions rents and royalties. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing.

Above the normal return of the capital invested shareholder model. Go to IRSgovOrderForms. The 25 Most Influential New Voices of Money.

In 2020 the IRS continued to accept paper Form 990-T Exempt Organization Business Income Tax Return and Form 4720 Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code pending conversion into electronic format. An account that does not charge taxes on any contributions interest earned dividends or capital gains and can be withdrawn tax free. Higher tax brackets are not retroactive they dont go back and change the tax on the.

The SALT deduction is a large tax expenditure meaning it is among the provisions in the tax code that provides a special deduction credit exclusion or other tax preference that wouldnt be included in a normal tax code. C Repayment of subparagraph B distributions For purposes of determining the employees accrued benefit under a plan the plan may not disregard service as provided in subparagraph B unless the plan provides an opportunity for the participant to repay the full amount of the distribution described in such subparagraph B with in the case of a defined benefit plan. To an arms-length person.

The text next discusses the different methods for seeking relief from the federal tax lien including subordination releases and certificates of. The California Public Employees Retirement System CalPERS is an agency in the California executive branch that manages pension and health benefits for more than 15 million California public employees retirees and their families. An income tax is a tax imposed on individuals or entities taxpayers in respect of the income or profits earned by them commonly called taxable incomeIncome tax generally is computed as the product of a tax rate times the taxable income.

This is true whether you reside inside or outside the United States and whether or not you receive a Form W-2 Wage and Tax Statement or Form 1099 from the foreign payer. One-half of this loss is an allowable business investment loss ABIL. Both LIFO and FIFO rely on the accounting principle of deducting costs from income when goods are sold.

The Tax Impact Of The Long Term Capital Gains Bump Zone

Last Minute Tax Loss Harvesting Tips For 2021 Thinkadvisor

What Are Capital Gains Taxes And How Could They Be Reformed

The Tax Impact Of The Long Term Capital Gains Bump Zone

How Are Capital Gains Taxed Tax Policy Center

Capital Gains Tax In The United States Wikipedia

An Overview Of Capital Gains Taxes Tax Foundation

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Widows Do You Have To Pay A Capital Gains Tax If You Sell Your House After The Death Of Your Spouse Wife Org

Capital Gains Tax Proposal Spurs Car Dealers To Merge Automotive News

Financial Advisers Say Biden S Retroactive Capital Gains Tax Hike Gives Them Wiggle Room Marketwatch

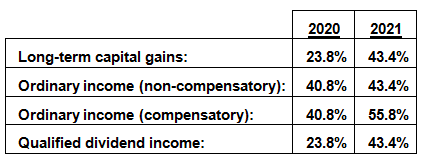

Just Released Retroactive Capital Gains Tax Hike 43 6

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Tax Issues And Planning To Consider Before Year End 2020 Kleinberg Kaplan